Home Loan Eligibility Criteria and Its Importance

Source: HomeCapital Website

Home loans and the whole cycle connected with them might seem like an endless challenge, but let us remind you that we are living in 2020. The internet and a host of startups have just made our lives and the process of home loans extremely easy. We would like you to sit back and relax while we disseminate the basics for example.

Having handled your finances well and being ready with the home down payment, let's step towards the application for a home loan. One of the major factors that determine your home loan eligibility is your income, however, other factors work behind the scenes.

Here are a few factors that need to be considered before taking a home loan:-

Home Loan Eligibility (Income Level)- Your earnings are the starting point for your home loan eligibility. How much money you are likely to give the lenders interest. Typically speaking, lenders are working to find 40 percent -50 percent of the profits to support the home loan. When you belong to a much higher income group, the greater would be your income rate. The more you receive, the more you pay but you are not allowed to go beyond the above amount. The percentage will vary from one lender to another and so the market analysis comes into play here. You have to prepare a budget to buy your new home and stick to it, and it is important to choose the right lender with the correct amount.

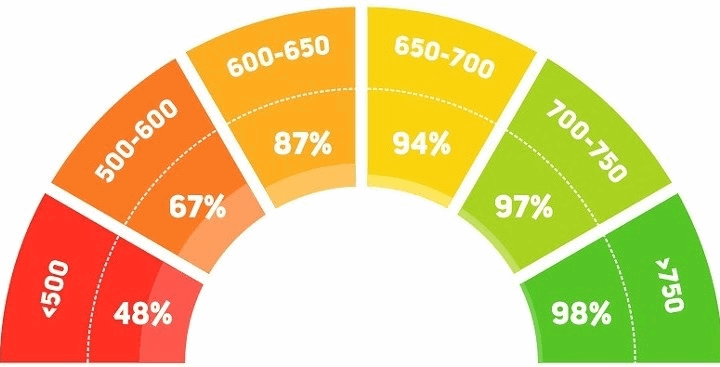

Why should you have a good Credit Score?- Better credit score varies between 700 and 900. For a variety of reasons, one needs a good credit score. One of the key reasons for this is that it means a higher chance of loan approval. The banks will give you a better deal if you have a decent credit score which could be lower interest rates, higher loan size, longer payment periods, and potentially breezy paperwork. A Bank will serve approx, with an outstanding credit score. Home loans pay 80 percent of real property prices.

Maximum Amount a Homebuyer can get for a home loan- The banks usually provide up to a limit of 85 percent of the loan against the value of the land. So, if you want a home loan to buy a Rs. 50 lakhs house, the maximum sum you can get is 85 percent of that ie 42.50 lakhs.

Documents required from the applicant- The basic documentation you will need for a home loan are- Application form, Photo, Identity proof, Address proof, Salary slip/ Form 16(Income Tax return), Bank account statement (the last 6 months bank statements).

Your age and remaining working years- Your age and the number of work years remaining also decide the duration of your home loan. As a rule of thumb, a salaried worker's retirement age is considered to be 60 years, and 65 years for a self-employed person. Now let's assume you're salaried and then in your 40s, as usual, you've quit your job for some 20 years. This would also reduce the amount of the home loan

Find the right co-borrower-. The amount of home loan you are eligible for will increase significantly if you add anyone the lenders would find to be a co-borrower. Both borrowers' total income will raise your home loan amount. Similarly, if you want a long term with the same salary, then the amount of home loan would also rise, and if you have ample money, you can prepay your home loan partially or entirely later down the road.

Homebuyers can now let go of their down payment burden with the help of HomeCapital. HomeCapital has pioneered an innovative home down payment assistance program for first time home buyers through which you can get up to 50% of your total down payment needs at zero cost.